Related report:

1. The Core Tension: When Predefined Scripts Diverge from Market Reality

In our in-depth report released yesterday, we outlined what we considered a textbook execution scenario:

First, price would sweep below $87.7K, confirming a 4H-level trend reversal (a lower low).

Only then would we look to initiate shorts on a rebound into $92K—a conservative approach rooted in classical Dow Theory and confirmed structural breakdown.

However, markets never follow scripts with mechanical precision.

What actually unfolded:

Bitcoin found support near $89.4K, never reaching $87.7K, and rebounded directly into our predefined short zone at $92K–$92.5K.

This creates a legitimate decision dilemma:

Without a confirmed breakdown below $87.7K, does $92K still represent a safe and rational short entry?

Our answer is yes.

But reaching that conclusion requires abandoning rigid prerequisites and reassessing risk–reward through real-time price behavior, not preconceived conditions.

2. Multi-Timeframe Structure: Why a Short Is Valid Now

2.1 Daily Timeframe: Inside Bar (Harami) Formation

On the daily chart, the candle printed on December 11 is fully contained within the range of the large bearish candle from December 10.

Pattern:This is a textbook inside bar / harami structure.

Market interpretation:An inside bar reflects hesitation and volatility compression following an impulsive move. After a sharp selloff (Dec 10), such consolidation typically resolves in the direction of the prior move, not as a reversal.

As long as price fails to reclaim the high of the “mother candle” (near $94.5K), the current consolidation should be treated as corrective, not constructive.

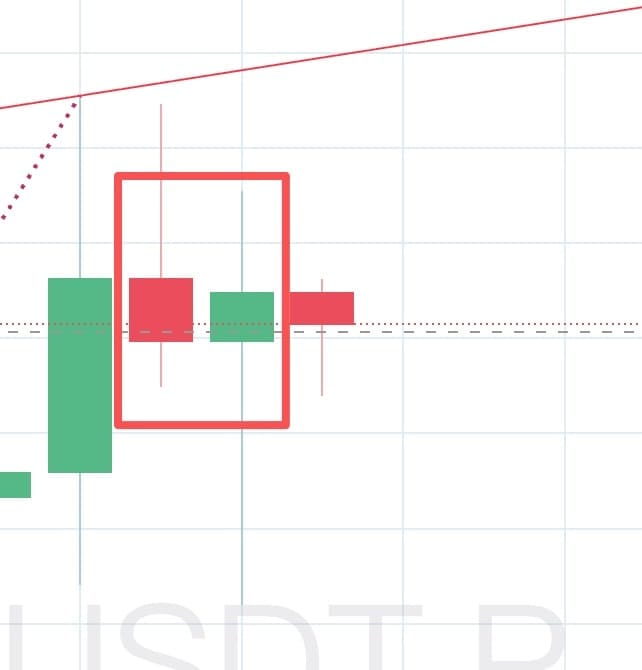

2.2 4H Timeframe: Precise Rejection at the Golden Pocket

Shifting to the 4H chart clarifies the nature of the rebound.

Golden Pocket Resistance:The rally peaked precisely within the 0.618–0.66 Fibonacci retracement of the decline from $94.5K to $89.4K.

Failure to reclaim structure:Despite tagging this zone, no 4H candle body has closed above the 0.618 level.

Under Smart Money Concepts, a rebound that fails to reclaim the golden pocket typically represents lower-high construction, not trend continuation.

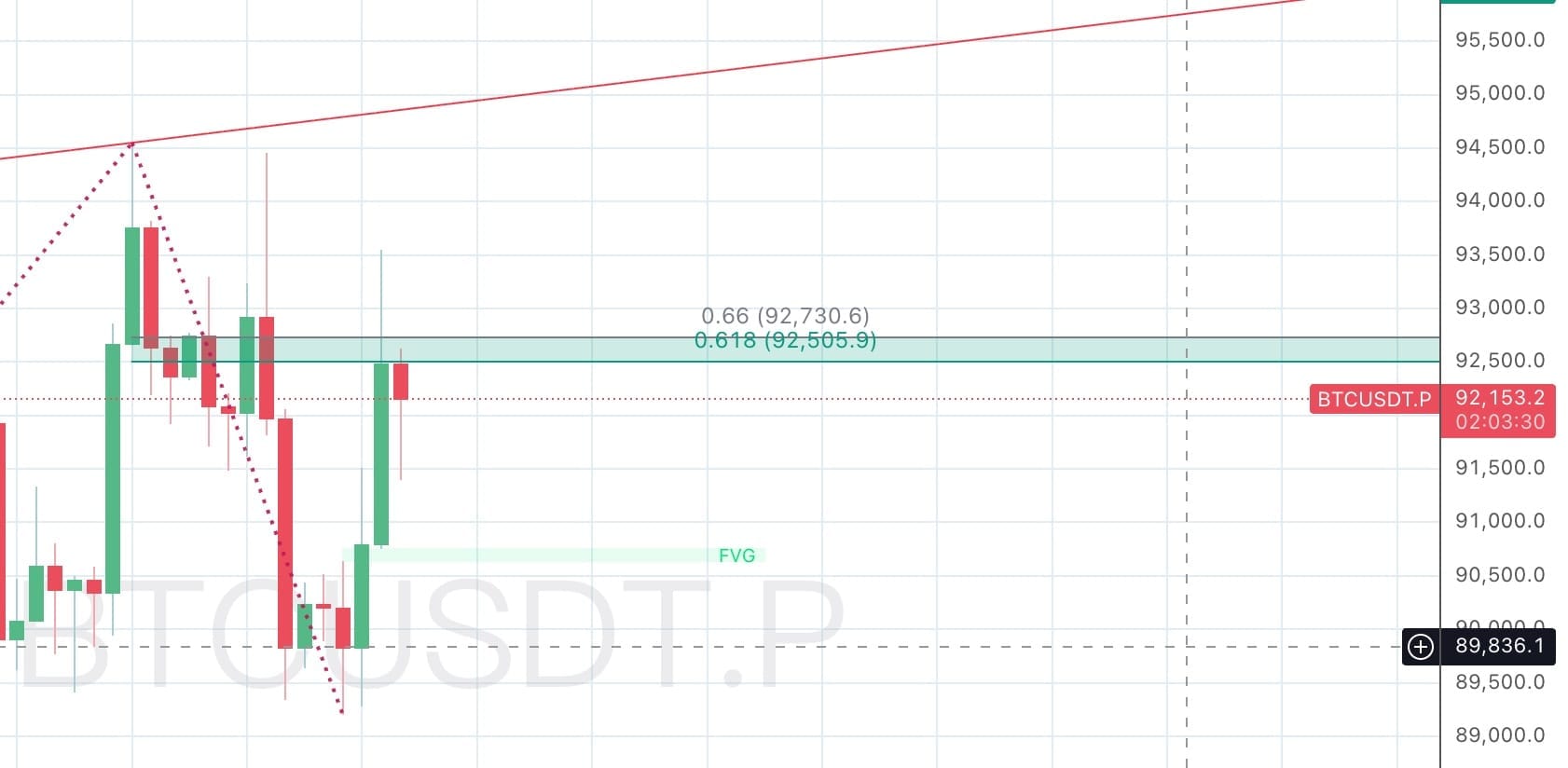

2.3 1H Timeframe: Micro-Structure at an Inflection Point

On the 1H chart, price action is now compressing near $92K, forming a potential short-term topping structure.

If price stalls and rolls over here, it confirms a micro-level trend shift.

While the higher-timeframe lower low (below $87.7K) has not yet materialized, a lower high around $92.5K may already be in place.

For aggressive, risk-aware traders, this constitutes sufficient structural justification for entry.

3. The Revised Trade Thesis

Based on the above, we no longer believe it is necessary to rigidly wait for a breakdown below $87.7K.

The current zone is already a high-quality decision point.

The core logic is asymmetric risk–reward.

3.1 Trade Execution Plan

Bias: Short

Entry Zone:$92,000 – $92,800 (scale in at current levels)

Leverage:Low leverage recommended(Given the absence of a confirmed $87.7K breakdown, volatility risk remains)

Invalidation / Stop Loss:$94,600

Why $94.6K matters:

This level marks both the prior swing high and the origin of the recent selloff.

A decisive break above $94.6K would invalidate the 1H bearish structure and negate the short thesis entirely.

Take Profit Targets:

- TP1: $87,700 (prior low / liquidity test)

- TP2: $83,700 (original liquidity-hunt objective)

4. Summary: Trading Is Probability, Not Prediction

Trading is not about predicting the future—it is about wagering on favorable probabilities in the present.

Bitcoin did not follow yesterday’s idealized script of “flush first, rebound later.”

Instead, it delivered an even clearer signal: a weak rebound directly into critical resistance, marked by golden-pocket rejection and momentum exhaustion.

Our recommendation is therefore to abandon rigid assumptions and engage the market as it is, not as we wish it to be.

With a clearly defined $94.6K stop, initiating shorts near $92K offers a highly asymmetric setup:

- If invalidated, the loss is limited and controlled.

- If structure resolves lower, the reward captures a substantial portion of the next downside leg.

This is not prediction.

This is disciplined, probabilistic execution.

Disclaimer

This report reflects the analytical views of Prism Insights and does not constitute investment advice. Cryptocurrency markets are highly volatile. Strict risk management and disciplined stop-loss execution are essential.