Part 1: Executive Summary: The Inevitable Collision of Structure and Catalyst

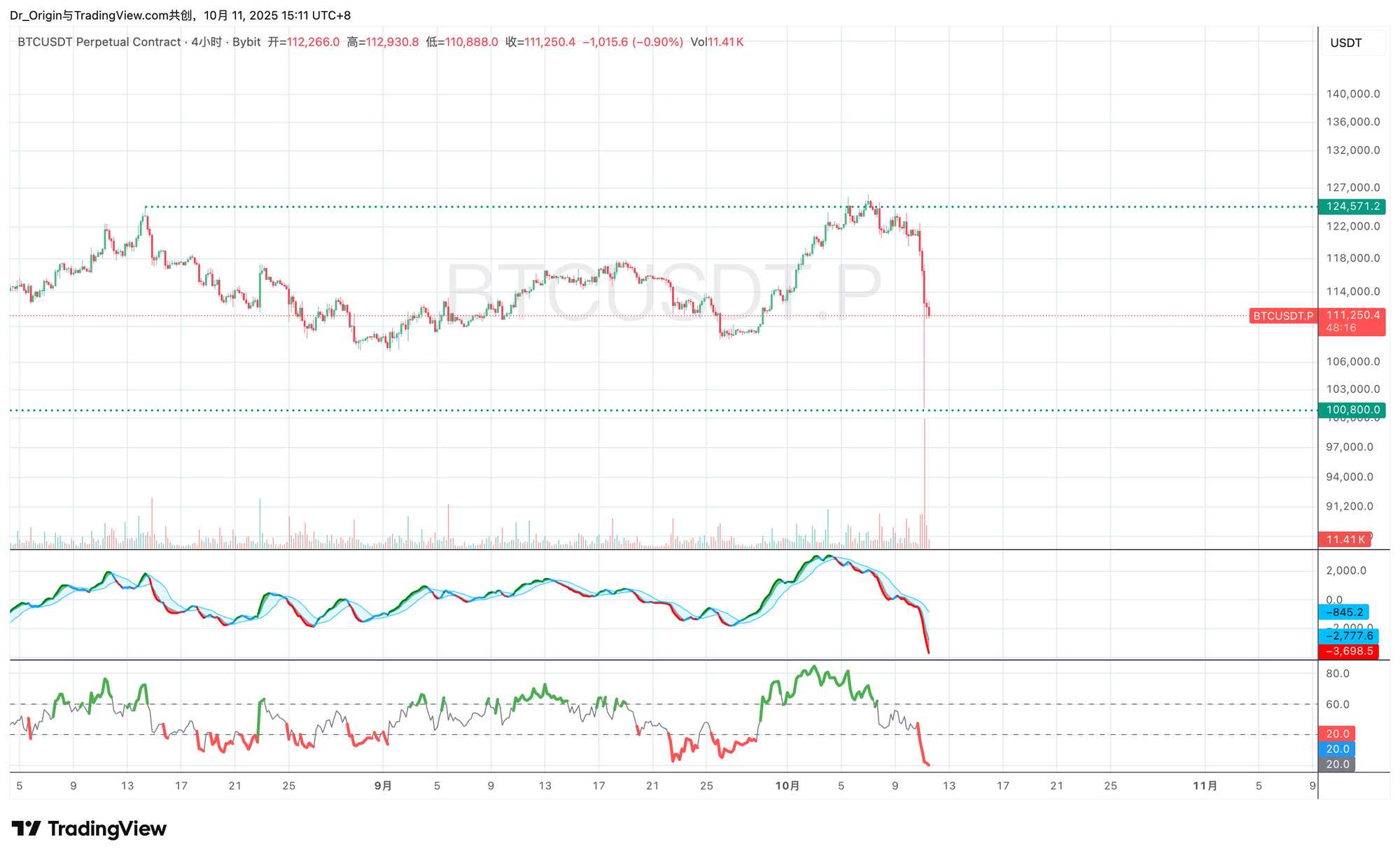

The October 11, 2025, market collapse was not an unforeseeable "black swan" event. It was the inevitable outcome of a structurally flawed market detonated by a predictable external catalyst. The severity of the event—a price cascade from over $120,000 to $100,000 in hours, triggering the largest-ever liquidation event in crypto history at nearly $20 billion—serves as a perfect validation of the core thesis presented in Origin Research's October 2 "2025 Q4 Strategic Outlook" report.

Our forward-looking report explicitly identified the market as being in the final, and most deceptive, phase of a macro distribution cycle. The report's central judgment was that any upward break of the prior high was highly likely to be a classic "Upthrust After Distribution" (UTAD) from the Wyckoff model—a meticulously engineered "bull trap" designed to hunt liquidity and create exit conditions for Smart Money.

On October 10, U.S. President Trump's statement on new China tariffs became the spark that ignited this fully-stocked "powder keg." However, it must be stated unequivocally: this geopolitical news was merely the trigger, not the root cause. The true origin of the collapse lay in the market's exceptionally fragile internal structure: record-high leverage, excessively crowded long positions, and clear on-chain distribution signals.

This event was a "Great Purge," which has fundamentally reset the market's leverage structure, participant sentiment, and risk perception. This report will illuminate the market's rules for our paid subscribers. In this moment, superior, first-principles-based research is the only path to future Alpha.

Part 2: Post-Mortem of a Perfect Forecast: Deconstructing the Prophecy

First, we will systematically review the core forecasts from our "2025 Q4 Strategic Outlook" report and compare them, one-by-one, against the market reality of October 11. The following table clearly demonstrates how our theoretical model translated into precise market prophecy.

This comparison table is not merely a summary of a successful call; it is a testament to a powerful analytical framework. It demonstrates that through a multi-dimensional, interdisciplinary analysis, the market's complex dynamics can be understood and its key inflection points anticipated. This ability to fuse macro narrative, micro-structure, and on-chain data is the core value of this institution and the fundamental reason our clients were able to make the right decisions during the market's most perilous moment.

Part 3: Post-Collapse Analysis: Why the Market Was Destined to Fail

The market's collapse was not accidental. It was the chain-reaction result of structural weaknesses buckling under external pressure. Using our seven-dimension framework as a lens, it is clear this "cascade" was a question of "when," not "if."

3.1. The Wyckoff Prophecy Fulfilled: Anatomy of the Ultimate Trap

Our core structural thesis—that the market was staging a Wyckoff distribution—was validated in textbook fashion on October 11. The strong rally from late September was not a bull market continuation, but the final act, meticulously directed by the "Composite Operator" (i.e., large institutions) to complete their ultimate exit.

The price chart clearly illustrates this process: The market built a trading range for weeks, then initiated an upward thrust in early October, briefly breaking the prior mid-August high of $124,571, creating what appeared on technical charts to be a perfect "breakout buy" signal. This, however, was precisely the "Upthrust After Distribution" (UTAD) described in Wyckoff theory. Its dual objectives were:

- Hunt Shorts Upward: Trigger all stop-loss orders placed above the prior high, turning those passive sell orders into active market buys.

- Induce Longs (The "Bagholders"): Create the illusion of a new all-time high, attracting the final cohort of momentum traders and retail investors to provide sufficient buy-side liquidity for distribution.

Once these two objectives were met, price support evaporated. The subsequent crash—a swift and violent plunge back below the $124,571 level—was the definitive confirmation signal of the UTAD failure. This price action perfectly replicated the 2021 topping script, proving that market structure and the operational logic of Smart Money are highly repeatable. This event is eloquent proof that chasing price momentum, detached from an analysis of market structure, is the fastest path to portfolio ruin.

3.2. The $20 Billion Inferno: A Systemic Purge Driven by Leverage

If the Wyckoff model was the script, the extreme leverage in the derivatives market was the fuel for the tragedy. As we warned in our October 2 report, the nature of market risk had undergone a "phase shift"—evolving from an environment ripe for a "short squeeze" to a high-risk structure vulnerable to a "long-on-long" stampede.

The pre-crash market condition was a perfect powder keg:

Extreme Greed: As prices rallied, Funding Rates remained at high positive values. This indicated that leveraged longs were paying a steep premium to maintain their positions, and sentiment was completely dominated by greed.

Record Open Interest (OI): Total OI in Bitcoin perpetuals surged to an all-time high in early October, with various sources placing it in the $220 billion range. Such a massive volume of leveraged positions represented an enormous, unstable store of "potential energy."

When the external shock from Trump's comments arrived, spot-side selling pressure began. In such a highly leveraged system, any meaningful price drop triggered a chain reaction: the first wave of long stops and forced liquidations was hit, which pressed the price lower, in turn triggering more liquidation orders at lower price levels. This process formed a devastating positive feedback loop: the "long-on-long" liquidation cascade.

In the end, this inferno consumed nearly $20 billion in leveraged positions within 24 hours, the vast majority of which belonged to overconfident longs.

Part 4: Navigating the Post-Crash Landscape

With nearly $20 billion in leverage forcibly purged and sentiment instantly flipping from extreme greed to panic, the "rules of the game" in the crypto market have been fundamentally rewritten. Understanding this structural "Great Reset" is the prerequisite for future strategy.

We anticipate a brief rebalancing period. The October 11 cascade, while brutal, effectively removed the most unhealthy leverage from the system.

However, any attempt to "buy the dip" or go long on leverage is foolish. Our October 2 report stated clearly:

"Once this meticulously engineered 'hunt' is complete, the market... will face a violent, long-term downtrend, i.e., entry into a multi-quarter macro bear market."

There is nothing new on Wall Street; speculation is as old as the hills. Any "draw-up" (rebound) in Bitcoin is now another opportunity to add to short positions.

If you are a new member or wish to add to your short position, here is the tactical plan. (To reduce market impact, specific levels are for members only.)

Bitcoin is expected to rebalance over a 2-5 day consolidation. Some slow-moving, stubborn longs will re-enter. This will be the Smart Money opportunity to add to shorts.

When Bitcoin draws up to the $113,800 - $114,800 zone, consider adding to short positions.

Special Note: The optimal short opportunity was the UTAD failure. Shorting now no longer has the same clear price advantage. You must manage your risk accordingT to your own tolerance.

Risk Warning: Leverage of any kind can result in the total loss of your capital. We do not recommend users employ more than 3x leverage.