Our analytical framework remains one step ahead of the market. For now, remain patient and manage your short positions. The endgame ($90,000) is imminent, and we are already mapping the game that comes after. Stay tuned to our research

1.Autopsy and Outlook

The Prism Insights macro-bearish framework, which has held a 100% validation record since October 2, just underwent its ultimate stress test. The market first rejected from our $104,000 core short zone, as predicted. It then, in an extreme, high-volatility event, "wicked" violently through our $107,000 "bait" level.

This move exceeded our tactical expectation, but it is not a failure of our framework. It is the final confirmation of our endgame manipulation thesis. This spike was a meticulously engineered, high-volatility inducement, designed to hunt all remaining liquidity on both sides of the market before the primary downtrend begins.

1.1 The 100% Validated Macro Framework

Our entire analytical narrative began with a 100% validated macro judgment: the $125,000 top was a textbook Wyckoff UTAD (Upthrust After Distribution). The power of this thesis was its insight into game theory: large institutions must engineer a liquidity-rich environment to complete their distribution. The $20 billion liquidation cascade on October 11 was the irrefutable, perfect validation of this high-conviction call.

1.2 The Evolution of the "Ultimate Weakness" Thesis

Following that crash, we identified the "front-running" behavior at $116,000. This insight became the cornerstone for all subsequent analysis. It revealed that the market had entered a state of "Ultimate Weakness". Operators had so little confidence in the market's ability to absorb supply that they were forced to distribute before the optimal liquidity point ($116,500), fearing the market was too fragile to even support an additional $500 rally.

1.3 The Game Theory of the Nov. 5 Report: "Bait" vs. "Trap"

Based on this validated framework, our November 5 report, "Ultimate Weakness: Bitcoin Finds Support at $100K," proposed a high-level game theory forecast:

- The Bait: $107,000. This was the obvious, consensus rally target—the first key resistance and the most logical place for "chase-shorts" to place their stop-loss orders.

- The Trap: $104,000. We predicted that due to "Ultimate Weakness," operators would lack the strength to even reach the $107,000 bait. They would front-run again, distributing early in the $104,000 "trap" zone (a key 4H FVG and 0.618 retracement).

Our Advice: Short the $104,000 trap, as we did not expect price to reach $107,000.

1.4 Autopsy of the "Unexpected" Event

Happened: The market precisely rejected our $104,000 trap zone, and our recommended short positions were perfectly filled. However, as the "U.S. Government Reopening" news hit, price launched a brief, violent spike, liquidating through the $107,000 bait zone before instantly collapsing back to the $103,000s.

This "unexpected" spike is not a failure. It is the highest-level confirmation of the Ultimate Weakness thesis.

A real, strong rally would have consolidated and held $107,000 as support. What we saw was a pure, instantaneous wick—a classic stop-loss hunt designed only to harvest liquidity.

The Deeper Logic:

- Our Nov 5 thesis was: Operators are too weak to hit $107k, so they will front-run at $104k.

- What actually happened: As operators tried to sell at $104k, they were met with a surplus of liquidity. Why? Because the "good news" of the government reopening brought in more "sucker" longs... than anticipated.

- This unexpected fuel gave them the power to launch one final, endgame manipulation.

- They were able to ignite all known liquidity pools, including those above $104k and the final pool above $107k.

- Conclusion: We now expect more consolidation as this "good news" continues to draw in more sucker-longs, giving operators more opportunities to hunt liquidity before the final, decisive drop.

2.Current Analysis: The Pre-Cascade Consolidation

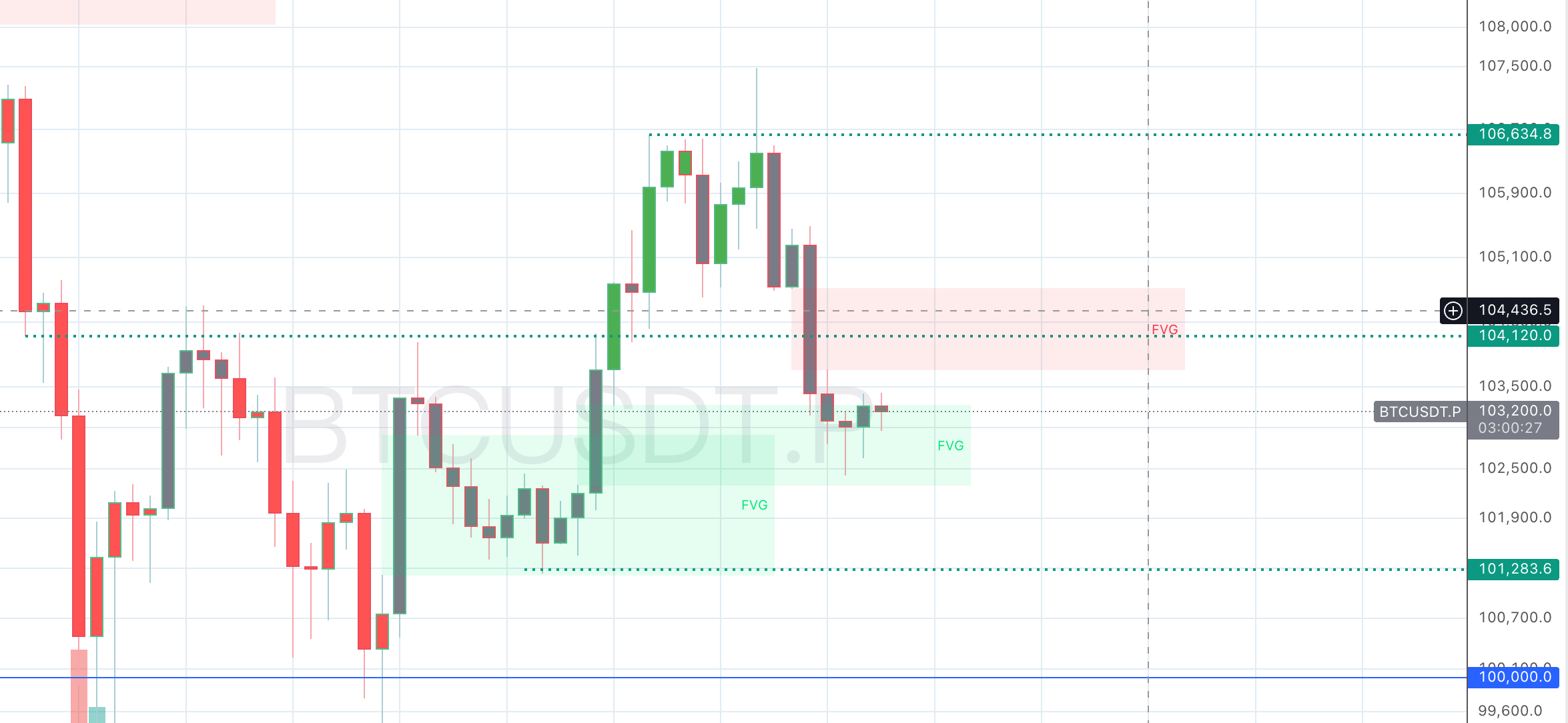

Price has now fallen back to the $103,000 area. We expect the market to consolidate in this range for about another week.

From a technical standpoint, this consolidation range has a dual purpose:

- Induce Longs: Dip-buyers who see the price drop from $107k and stabilize at $103k will view this as a successful support test and begin to open new long positions.

- Shakeout Shorts: Impatient, short-term shorts who profited from the $107k drop will grow nervous in the chop and take their profits, closing their positions.

When this range inevitably breaks to the downside, both of these groups will become fuel for the cascade. This is the "liquidity farm" mechanism we have described before: the market must first cultivate counter-trend liquidity before executing its primary trend.

(The following section contains precise, high-profitability price targets and is available to paid subscribers only. Do not share this content.)