The Observer's Paradox: Our 1% "Imperfection"

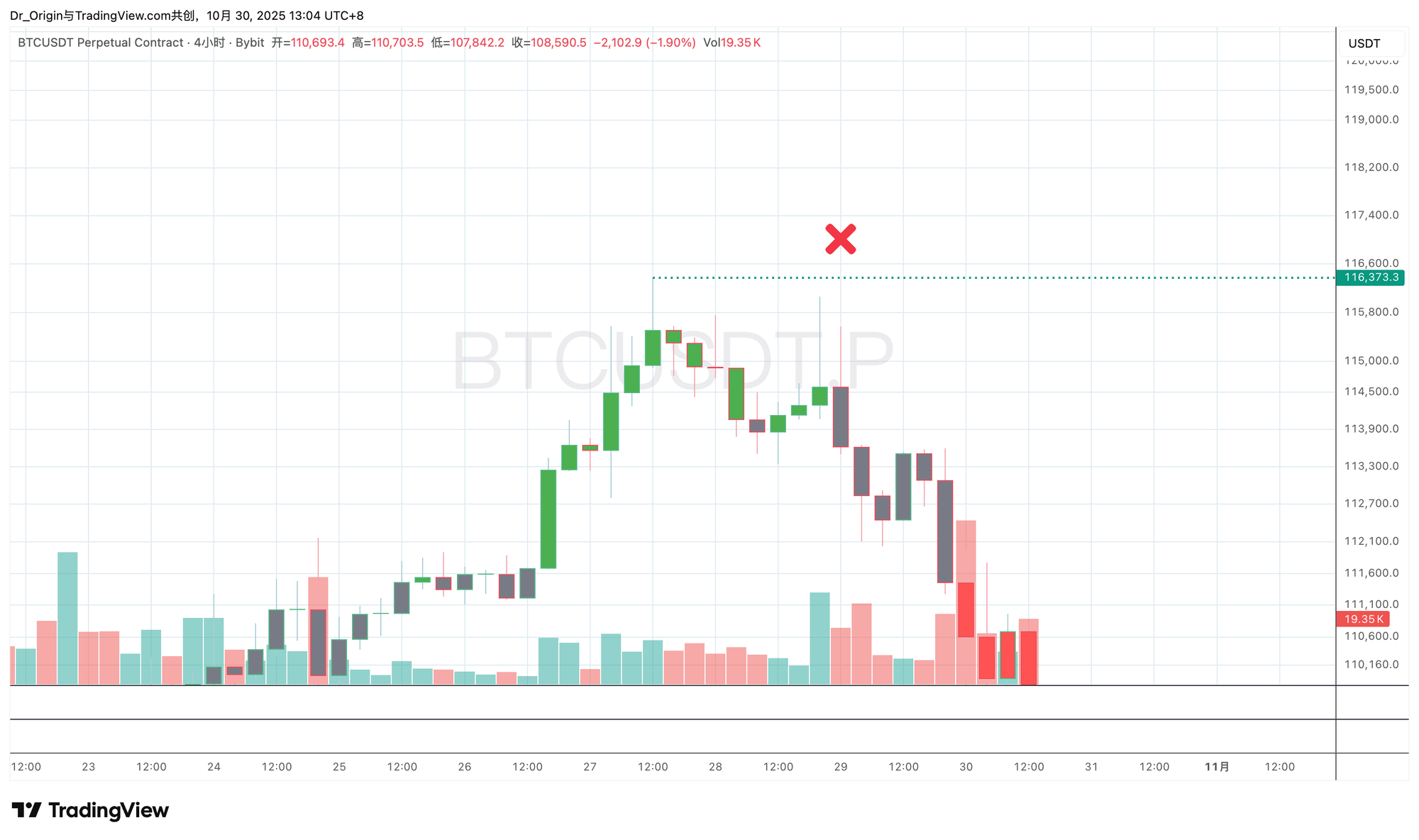

Since October 2, the Prism Insights analytical framework has achieved irrefutable validation in the market, culminating in a 100% perfect prediction record. Most notably, in our report "Validation: $116,000 Is Here. This Is The Short Plan," we precisely identified the $116,000 level as the key short entry. The market's subsequent move confirmed this judgment in its entirety. This success was built upon our prior insights into market structure—specifically, that the market was operating as a meticulously designed "liquidity farm" to cultivate and ultimately harvest shorts, all to service large-scale institutional distribution.

However, a significant anomaly has emerged, which demands analysis: the secondary spike we had warned of—a final liquidity hunt targeting $116,500—never fully materialized. Price came to an abrupt halt after its first probe above the $116,000 zone. This phenomenon is not a failure of our framework. On the contrary, it is the ultimate and most powerful confirmation of both the influence of Origin Research's analysis and the market's extreme structural fragility. This was a classic "front-run," executed by "smart money"—or the "Composite Man" of our Wyckoff analysis—who dominate the meta-game.

This event reveals a profound shift in market dynamics. Due to its persistent accuracy, our analysis is no longer a passive observation of the market; it has become an active variable within the game itself. When a high-value analysis is widely disseminated, large-scale participants are forced to incorporate it into their own decision-making models. They knew that a significant number of traders following our strategy had layered short orders around the $116,500 target. This presented them with a game-theory dilemma: wait for the target and compete with our followers for limited liquidity, or act preemptively, front-running the move to complete their own distribution. They chose the latter.

This move was not a sign of strength; it was a testament to profound weakness and a crisis of confidence. Had these entities believed enough organic buy-side demand existed to stabilize price, they would have patiently waited for a better exit. Choosing to front-run the target exposes their extreme distrust in the market's ability to absorb supply. They concluded that buy-side depth was so fragile it could not even support an additional $500 rally. Therefore, this aborted hunt is more bearish than a successful one, as it reveals the market's true, hollow nature. It validates, irrefutably, our dire warnings from the Q4 2025 Strategic Outlook about the market's systemic internal fragility. The market has evolved from a simple game of supply and demand into a complex meta-game, and Prism Insights's analysis has shifted from that of a third-party observer to that of an active, influential force.

Dissecting the Vacuum: Recalibrating the Bear Thesis for the Final Descent

The structural decay confirmed by this "front-running" anomaly forces us to recalibrate the market's forward path. The price chart below precisely depicts the inevitable result of this logical deduction and will serve as the visual thesis for our updated bear case. We forecast that the market will not only reverse its recent rally but will erase the entirety of its gains since April 2025, breaking below the $90,000 key psychological level.

This more severe prognosis stems from the impact of recent events on our proprietary "Seven-Dimensional Analysis Framework," which was first introduced in our foundational Q4 2025 Strategic Outlook. The current front-running has significantly degraded the ratings of several key dimensions within this framework:

- Market Structure (Game Theory): Rating downgraded from Extremely Bearish to Terminal. The classic Wyckoff UTAD has not only occurred, but its smaller-scale "fractal echo" has shown a premature, incomplete failure. This indicates that the institutional distribution process is being forcibly accelerated; they are sacrificing optimal pricing to ensure their exit.

- Derivatives Market (Leverage & Sentiment): Rating updated to Path of Max Pain: Down. The market's risk dynamic has fundamentally shifted. The prior focus was hunting shorts to create upward fuel. However, with shorts now partially cleared or cautious after the $116,000 probe, the largest and most vulnerable pool of capital is the "buy-the-dip" crowd that entered post-October 11. Therefore, the path of least resistance and maximum pain is no longer an upward short squeeze; it is a downward liquidation cascade targeting longs.

- On-Chain Health: We previously identified that Long-Term Holders (LTH) were in continuous distribution. The latest market action—a lack of strong buy-side follow-through—will only accelerate their urgency. We expect on-chain data to show LTH distribution is accelerating, as they are spooked by the market's inability to make a decisive breakout and are now exiting at any cost.

The market's "destruction engine" has switched its fuel source. It is no longer burning shorts for upward thrust; it will now burn the conviction and capital of LTHs and dip-buyers to gain downward acceleration. The failure of the upward manipulation makes a "hunt" for liquidity below the only remaining path for large entities to complete their distribution. The sub-$90,000 target is not arbitrary; it points precisely to the price range that will trigger the next mass long-liquidation cascade. This is the critical exit liquidity that "smart money" failed to capture at $116,500.

Market Structure: The Path Through the Vacuum

A deep technical analysis of the Bitcoin chart provides the structural necessity for the path below $90,000. The analysis centers on a critical, often-overlooked concept: Fair Value Gaps (FVG). FVGs are not mere blank spaces on a chart; they are the precise signature of market imbalance and a liquidity vacuum. When price moves rapidly in one direction, the healthy, two-sided market mechanism fails, leaving a trace of un-filled orders. These zones act as gravitational wells, exerting a powerful pull on future price.

The current chart clearly reveals a significant FVG formed in the Spring of 2025, located below $90,000. With the distribution top now confirmed and upward momentum exhausted, this liquidity vacuum has become the market's primary, structural center of gravity. The market has an inherent tendency to return to efficiency, and it will do so by revisiting these imbalanced zones to "re-balance" the order book and facilitate trade.

The coming decline has a dual nature: it is not just a technical correction but a full-scale psychological assault. The strategic intent is to punish every market participant who has held any form of bullish conviction over the last seven months. By destroying the entire "bull market continuation" narrative, the market will ensure the most thorough capitulation and wealth transfer possible—a necessary condition for the completion of any macro distribution cycle (as described by Wyckoff).

We must re-emphasize the "reenactment" concept from our "Validation: $116,000 Is Here" report. The coming crash will, in structure and form, be a large-scale reenactment of the sharp top-reversal on October 11. The internal mechanism will be identical: a sudden loss of key support will lead to a rapid, cascading collapse through a liquidity vacuum. The only difference will be the amplified scale and scope of the move. The market's path is not random; it always seeks the most efficient route to inflict maximum psychological pain, as this is necessary to create a true, cyclical bottom from which the next bull market can begin. Therefore, a rapid cascade through the FVG, not a slow bleed, is the necessary choice to achieve this goal.

The Retail Capitulation: Crypto Has Entered the Pro-Player Era

The market's path is increasingly clear. The current calm is not the prelude to a recovery; it is the market reloading ammunition for a final, more destructive decline. The "front-running" anomaly at $116,000 was not a random market fluctuation; it was the decisive signal confirming the market has entered its terminal stage. It reveals a collapse in confidence among large participants and the exhaustion of buy-side-demand. The path of least resistance and maximum pain is, without question, to the downside.

As this institution has repeatedly stressed, the era of simple, momentum-driven investing is over. The market has fully entered a "pro-player's era". In this environment, the ability to generate alpha no longer stems from audacity or emotion, but from a deep, structural understanding of market microstructure, liquidity dynamics, and game theory.

The Prism Insights framework is built for this complex endgame. We combine macro Wyckoff distribution structures with the micro-mechanics of liquidity hunts and FVG gravity-theory, and we integrate the meta-game understanding of the "observer effect". This multi-layered analytical capability is designed to provide our subscribers with the clearest, most reliable navigational chart through the treacherous market landscape ahead. The complex endgame has begun, and our research is the key to victory.

We are officially launching our institutional-grade research service. For partnership opportunities or service inquiries, please contact our assistant (bitorin).