I. A Review of the Validated Analytical Framework

1.1 Core Premise Reiterated: The Wyckoff Distribution Thesis

Our Q4 2025 Strategic Outlook presented a core, high-conviction thesis: the market is in the final, most deceptive phase of a large-scale Wyckoff Distribution cycle—the Upthrust After Distribution (UTAD). That analysis specified, with no ambiguity, that the seemingly powerful rally was not a new bull market, but rather a precision-engineered event to create exit liquidity for large-scale participants, or "smart money".

The depth of this judgment goes beyond simple pattern recognition and into the core of market game theory. Large institutions needing to sell massive positions cannot simply dump them on a weak market; this would cause severe slippage and poor execution. They must, therefore, engineer a liquidity-rich environment. An upward break of key resistance is the most efficient solution. This move simultaneously triggers stop-loss orders from shorts (passive buying) and induces FOMO-driven retail traders to chase the breakout (active buying). The UTAD was not a possibility; it was the economically inevitable, mechanical solution for large entities to complete their distribution under specific market conditions. The success of our framework stems from this deep insight into its game-theory necessity.

1.2 The Cascade Prophecy: Warning of Asymmetric Downside

The initial outlook clearly warned that the market's risk profile had undergone a "phase change," shifting from a "short squeeze" environment to a high-risk structure prone to a "long-on-long" liquidation cascade. The report identified the record-high Open Interest and persistently positive funding rates as a "powder keg" awaiting a spark, accurately diagnosing the market's primary vulnerability—extreme leverage—as the key transmission mechanism for the coming crash.

1.3 The Narrative Arc: From Prediction to Validation

Our analytical narrative—from the initial prediction of the UTAD, to its violent validation in the October 11 market crash, to our dissection of the post-crash "interlude"—now converges on the final, highly-actionable forecast presented in this report.

1.4 The Psychology of the Grind: "Death by a Thousand Cuts"

As we noted in our community this week, the current descending channel is a psychological tactic with a dual purpose:

- Eroding Longs: The slow, grinding decline is designed to "bleed out" the 'buy-the-dip' crowd through a "death by a thousand cuts," systematically stopping them out and exhausting their capital and conviction.

- Cultivating Shorts: More critically, the channel's clean, predictable boundaries are systematically "training" traders to short the top rail. This compels them to place their buy-stop orders in a dense cluster just above the descending trendline, deliberately accumulating a large, concentrated pool of buy-side liquidity.

1.5 The Channel as a "Liquidity Farm"

This is not a passive price pattern; it is an active liquidity engineering process. Market makers and operators need this cultivated pool of short-stops to execute their final, large-scale sell orders (distribution) without causing significant slippage. The "harvest" being farmed is the buy-side liquidity of these short traders.

The market's risk state has shifted from the obvious, greed-driven risk seen before the crash to a subtle, designed, and hidden risk. The current low-volatility environment feels safer to many, yet it is being systematically prepared for a violent, targeted manipulation. The danger is less visible, but more lethal and concentrated.

II. The Liquidity Hunt is Imminent

2.1 The Manipulative Spike: A UTAD Re-enactment

The sharp, upward spike we forecast is not a genuine recovery or breakout attempt. It is a calculated liquidity hunt. This move can be clearly defined as a smaller-scale "re-enactment" of the larger UTAD that preceded the October 11 crash. Its underlying manipulative principle is identical, aimed at achieving two goals:

(Due to the highly profitable nature of the following content, which carries influence and value on par with our Bitcoin top-short report, this section is available to paid subscribers only.)

- Stop Liquidation: Trigger the massive clusters of short-stop buy orders accumulated above the descending channel, providing deep, concentrated buy-side liquidity for large sellers.

- Inducement: Create the illusion of a bullish breakout, luring in FOMO-driven breakout buyers. These "chasers" will provide the final wave of "exit liquidity" that smart money needs to sell their positions at a high price.

2.2 Deconstructing the "Optimal Solution" (Game Theory)

The game theory behind why this manipulative spike is the "optimal solution" for an operator is critical. A direct breakdown from this channel, while directionally correct, would be inefficient. It would fail to harvest the massive pool of buy-side liquidity resting above the channel. By engineering an upward spike, operators can sell into a buying frenzy they themselves created, maximizing their exit price and execution efficiency before initiating the real decline.

2.3 The Reversal and Cascade: The Path Below $100,000

Once the large sell orders are absorbed by this manufactured liquidity, the artificial buying pressure will vanish, exposing a buy-side vacuum. The subsequent price collapse will be swift and violent, trapping both the stopped-out shorts and the induced longs. As noted in our previous report, the primary target for this decline is the key psychological and structural support level of $98,000 - $100,000.

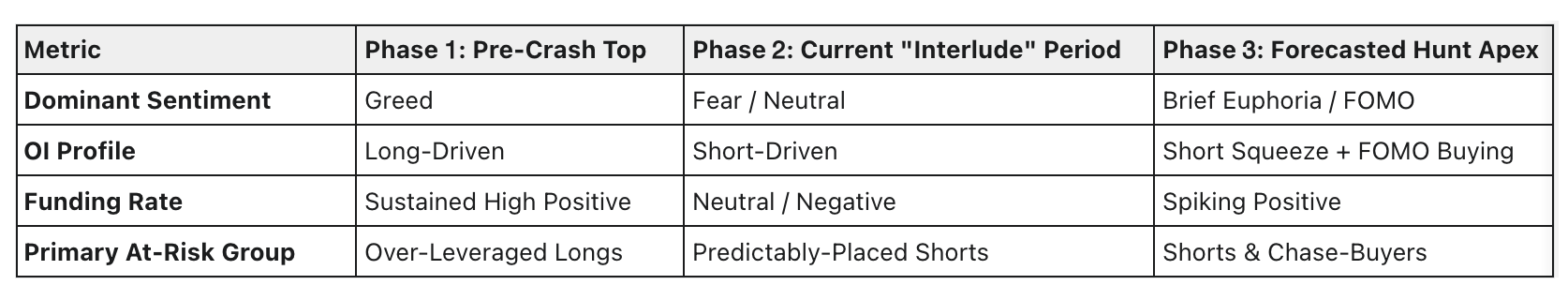

To illustrate this evolution, we present the market dynamics across three key phases.

The Market Dynamics Across Three Phases

III. A Strategic and Tactical Guide

3.1 The Optimal Entry Zone

The highest-probability, best risk/reward entry is not within the current descending channel. It is at the apex of the forecasted liquidity hunt. Combining the current chart structure, key Fair Value Gaps (FVGs), and Fibonacci retracement levels, the primary shorting entry zone is in the $115,900 - $116,100 range.

3.2 Price Targets & Milestones

- Target 1 (Primary): A break below the $100,000 psychological support level.

- Target 2 (Extension): Exploration of lower structural support, contingent on the violence of the break.

3.3 Forecast Invalidation Criteria

This forecast will be invalidated if, and only if: the price pushes above the liquidity hunt's apex and subsequently succeeds in consolidating above that level, turning prior resistance into firm support. This would indicate the move was one of genuine absorption, not a manipulative trap.

3.4 Risk Management

We must reiterate our warning: "Any amount of leverage can cause you to lose all your capital; we do not recommend users use more than 3x leverage". In an environment this volatile and professionally manipulated, capital preservation via strict position sizing and hard stop-losses is paramount.

IV. Conviction Amid Complexity

The path of least resistance—and maximum pain—is down. The market is not recovering; it is reloading. The current quiet consolidation is a feature, not a bug—it is the necessary interlude to engineer the liquidity required for the next major cascade. We predict this cascade will be triggered by one final, deceptive bull trap.

As the October 11 crash proved, the era of simple, momentum-driven investing is over. The market has entered "a pro-player's era". In this environment, Alpha is no longer a function of audacity, but of a superior understanding of market microstructure, liquidity dynamics, and game theory.

Our analysis, which combines the macro Wyckoff structure with the micro mechanics of liquidity hunting, provides the decisive edge for navigating this market. It moves beyond simple "bull" or "bear" narratives to provide a deep explanation of how and why the market will move.

The complex game has begun. This comprehensive report—combining prediction, validation, and a forward-looking guide—is intended to be the definitive map for the complex and treacherous market landscape ahead.